INTERNATIONAL CAPOEIRA RAIZ

Mestre Bailarino

capoeira

%

Years of Capoeira

+

Organize Events

+

International Capoeira Raiz

It is now spread across various cities in Europe such as Lisbon, Portugal, Madrid, Spain, Berlin, Germany, Warsaw and Breslau, Poland and Zaporozhye, Ukraine. The ICR Group is part of the Associação Capoeira Bem Viver, which was also created by Master Bailarino in 2007.

Lot's of people Lot's of capoeira

Capoeira

Free training

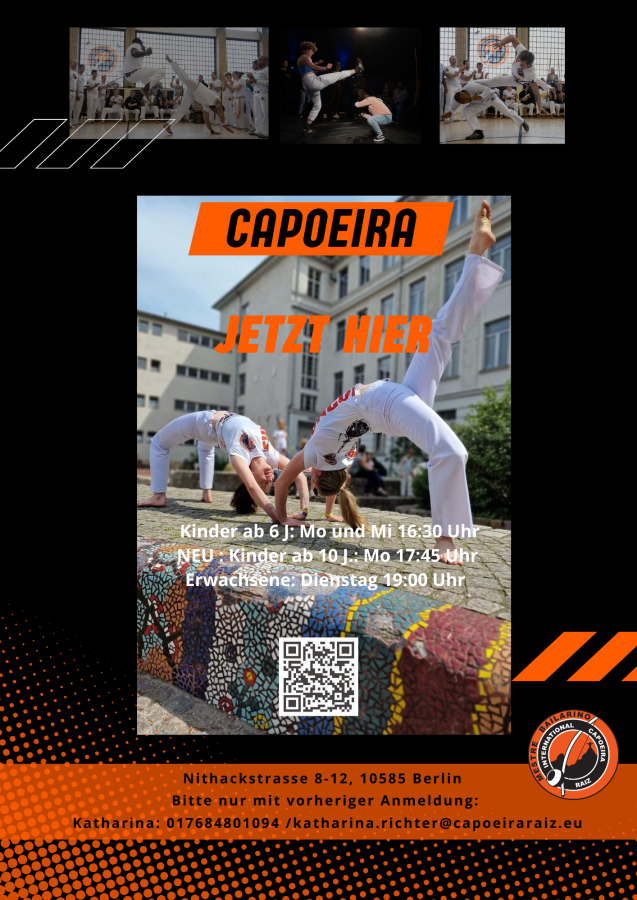

If you are interested in training with us, we would like to invite you to visit us.

Register here and we can arrange an appointment together.

Mestre Bailarino founded the International Capoeira Raiz (ICR) in 2007, offers several Capoeira classes and directs the International Capoeira Raiz group in Poland, Czech Republic, Ukraine, Portugal and Germany, with the vision of paying homage to the roots of Capoeira and its origins.

Since 2007 he lives and teaches Capoeira in Berlin.

“One cannot understand the flavors of a country’s cuisine without tasting it. Study the spices!"

Was born in São Gonçalo Rio de Janeiro on 25 June 1969. He began his Capoeira training with his cousin Jorge Azevedo Pinheiro. In 1980 he entered the Small Association of Capoeira Masters with Master Travassos, and 12 years later in 1992 he became a Master at the age of 23. In 1993 Master Bailarino joined the group Capoeira Muzenza with Master Alexandre Batata.

Master Bailarino

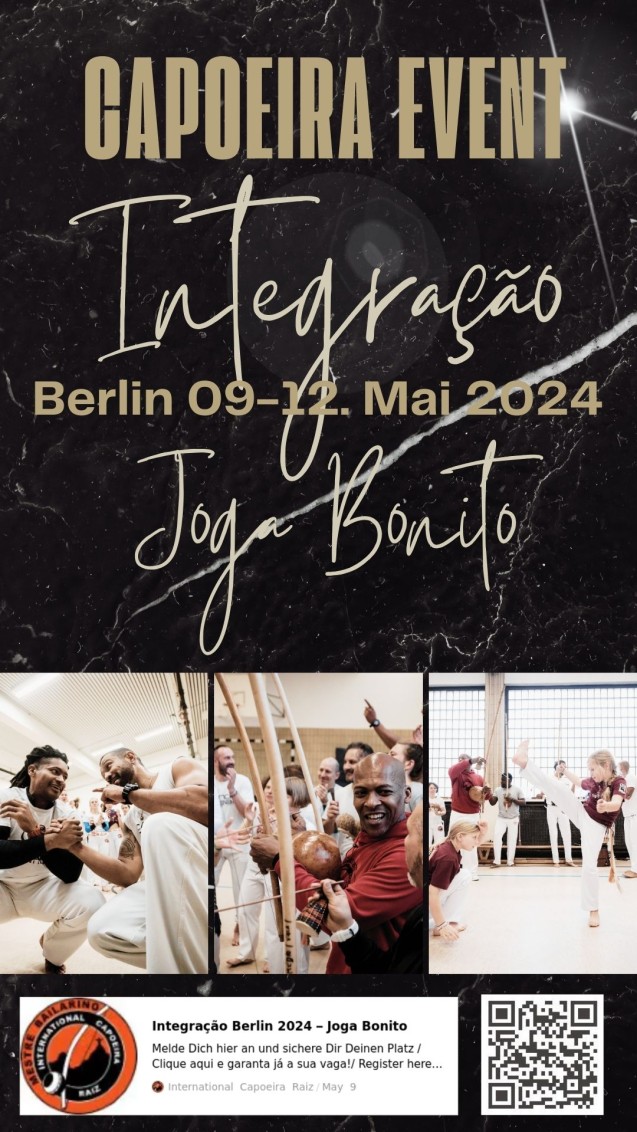

blog icr

Capoeira für Kinder & Erwachsene in Charlottenburg

Wir haben noch freie Plätze in unseren Kinder & Erwachsenen Capoeira Kursen hier im Kiez noch freie Plätze, seid herzlich eingeladen. Be welcome to join us for our Capoeira classes,